Now you see me, now you don't: using citizenship and residency by investment to avoid automatic exchange of banking information - Tax Justice Network

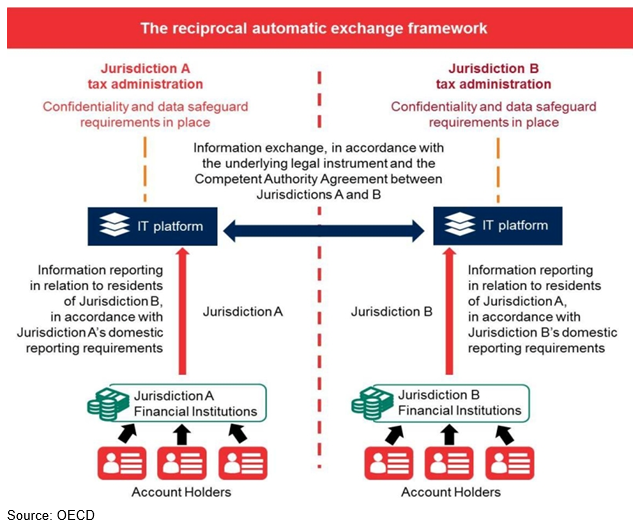

Managing the Automatic Exchange of Information for Financial Institutions in the Face of FATCA, CDOT, and CRS - Aberdeen Strategy & Research

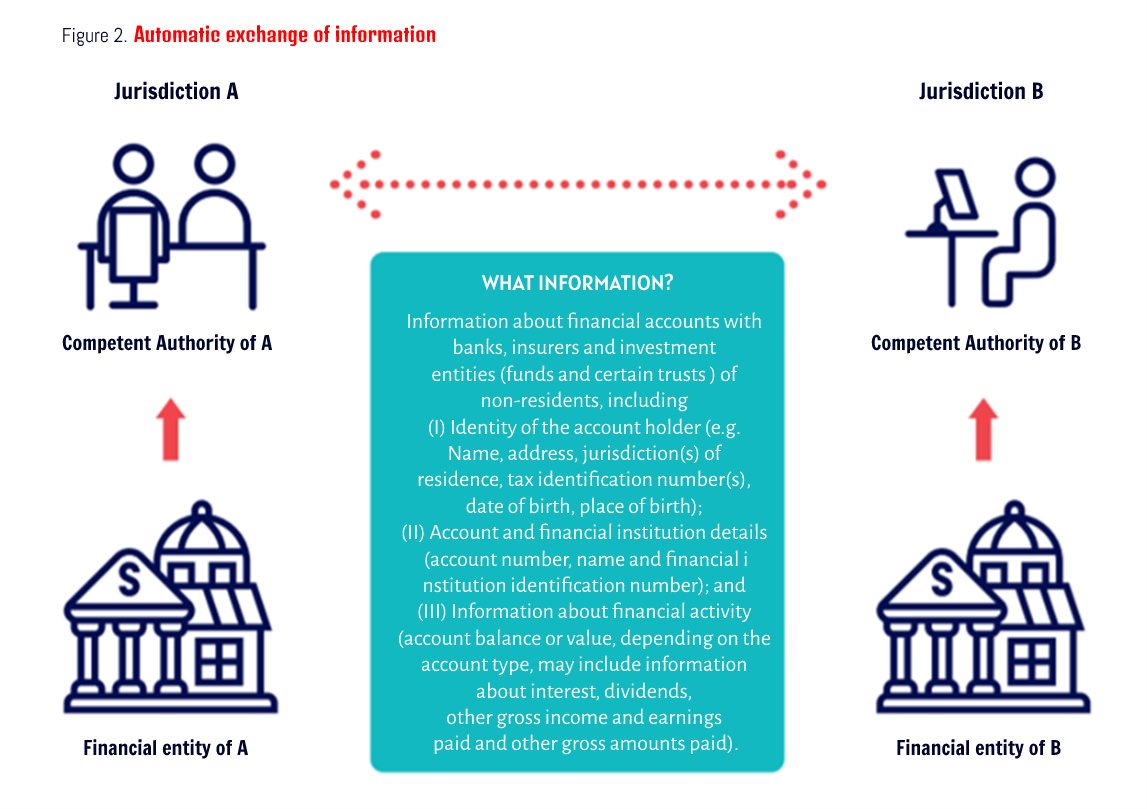

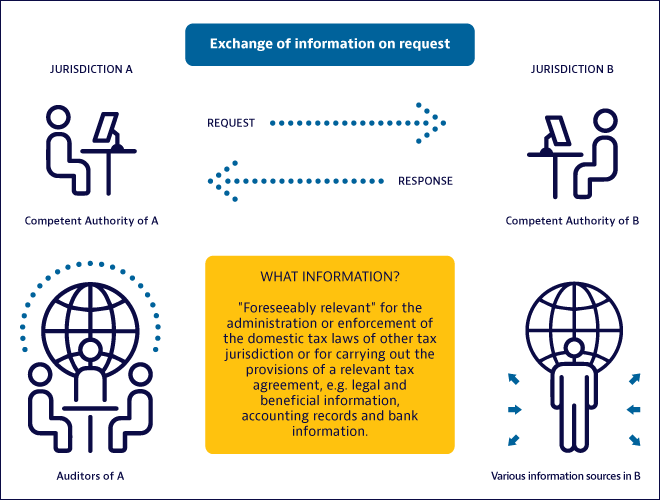

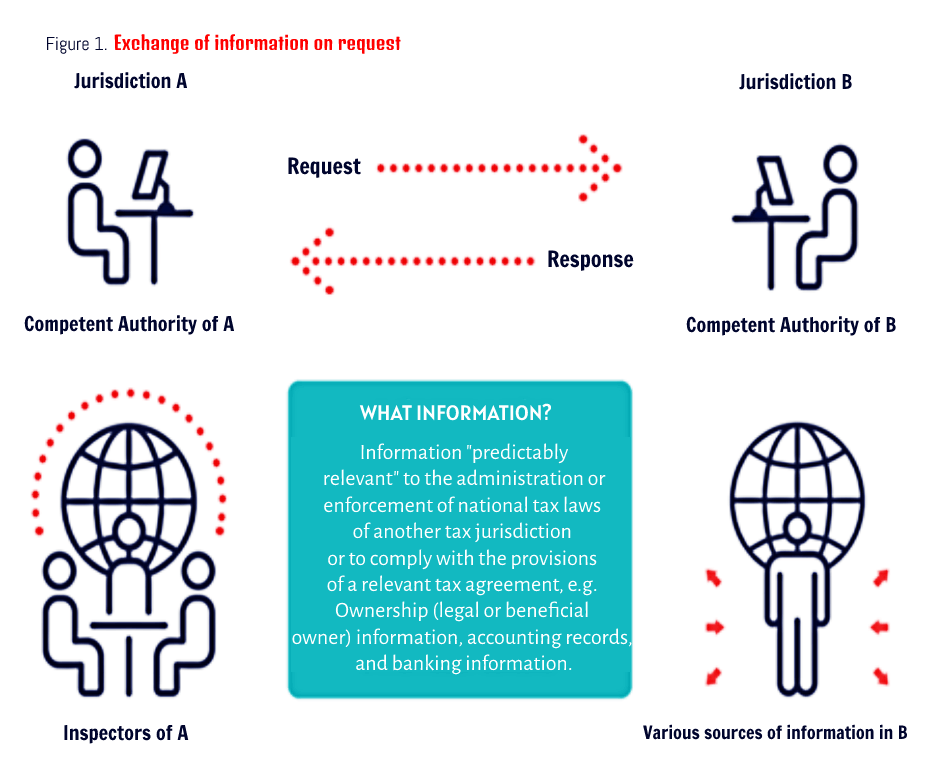

A fundamental tool for the Latin American Tax Administrations: the exchange of Tax Information | Inter-American Center of Tax Administrations

Spiramus Press | A Practitioner's Guide To International Tax Information Exchange Regimes - DAC6, TIEAs, MDR, CRS, and FATCA, By Grahame Jackson and Harriet Brown

Switzerland reported on over 3,4 million financial accounts under the automatic exchange of information in

Standard for Automatic Exchange of Financial Account Information in Tax Matters: Organization for Economic Cooperation and Development: 9789264267985: Amazon.com: Books

OECD Tax on Twitter: "Global network for automatic exchange of #tax information: +100 jurisdictions get ready to exchange #CRS information as of Sep 2018. See ➡️ https://t.co/geqdUwjwQ2 https://t.co/Tc476zLQp7" / Twitter